Welcome to the seventh edition of the e-Bulletin (Volume VI) brought to you by the Employment, Labour and Benefits (ELB) practice group of Khaitan & Co. This e-Bulletin covers regulatory developments (including those relating to the upcoming labour codes), case law updates and insights into industry practices that impact businesses from a sector agnostic standpoint.

Labour codes: story so far

In this section, we help you in understanding the developments that have taken thus far on the implementation of the 4 labour codes on wages, social security, industrial relations, and occupational safety, health and working conditions, which received the Presidential assent between the years 2019 and 2020.

Broadly speaking, the labour codes, which aim to consolidate and consequently replace 29 Central labour laws, are yet to be brought into force, barring provisions relating to

Moreover, even if the codes are fully brought into effect, the same would require issuance of rules, schemes, and notifications of the relevant governments so as to have a comprehensive revised compliance regime.

Under the labour codes, the 'appropriate government' for an establishment can be the Central Government or the state government, depending on the nature of its operations or the existence of multi-state operations. Such appropriate government has the power to inter alia issue rules detailing some of the substantive aspects broadly set out under the codes and also prescribing procedural compliances such as filings, maintenance of registers, etc. In the past year, several key industrialised states such as Haryana, Delhi, Maharashtra, Gujarat, Andhra Pradesh, Telangana, Tamil Nadu, and Karnataka released draft rules under some or all of the labour codes for public consultation. Among the industrialised states, notably, West Bengal is yet to release their draft rules under any of the codes.

Regulatory Updates

In this section, we bring to your attention, important regulatory developments in the form of notifications, orders, bills, amendments, etc. witnessed in the past one month in the context of employment and labour laws.

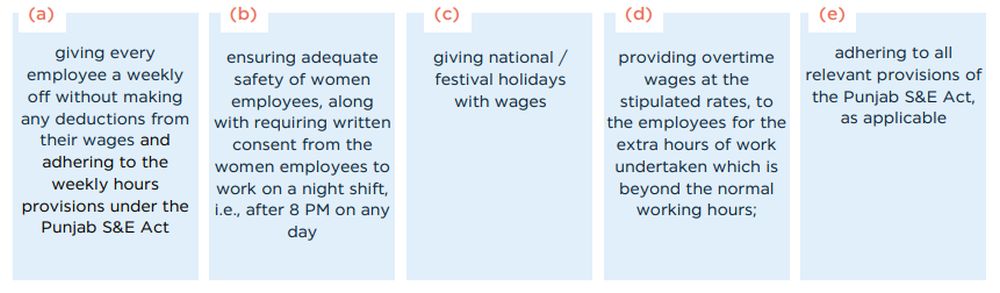

Chandigarh allows shops and establishments to operate 24*7

By way of a notification dated 25 June 2024, the Administrator, Union Territory of Chandigarh, has exempted all shops and establishments from the applicability of Section 9 (opening and closing hours), Section 10(1) (mandatory close day) and Section 30 (conditions for employment of women) prescribed under the Punjab Shops and Commercial Establishments Act, 1958 (Punjab S&E Act). This exemption is valid for 1 year from the date of notification in the Official Gazette. The exemption has been made subject to certain conditions, including:

Haryana mandates labour welfare fund contributions to be made monthly on the online portal

As per a circular dated 9 July 2024, the Haryana Labour Welfare Board has notified that employers are required to make labour welfare fund contributions on a monthly basis on the online portal.

Karnataka releases the draft rules under Karnataka Motor Transport and Other Allied Workers Social Security and Welfare Act, 2024

On 29 June 2024, the Government of Karnataka released the draft Karnataka Motor Transport and Other Allied Workers Social Security and Welfare Rules, 2024 (Karnataka Motor Transport Workers Rules) under the Karnataka Motor Transport and Other Allied Workers Social Security and Welfare Act, 2024 (Karnataka Motor Transport Workers Act), which will be effective from the date of their publication in the Official Gazette.

The Karnataka Motor Transport Rules encompasses provisions around the functions of the welfare board established under the Karnataka Motor Transport Workers Act, details concerning the tenure and resignations of the board members, and specifics on the registrations of the motor transport and other allied workers. The rules also outline the benefits extended to the registered workers in case of accidents, natural deaths, education assistance, and maternity benefits to registered female beneficiaries. Additionally, the procedure for appeals and timelines are also mentioned within the Karnataka Motor Transport Workers Rules.

Karnataka revises the duration for obtaining a gratuity insurance policy

Through a corrigendum dated 4 July 2024, the Government of Karnataka has revised the timeline for obtaining an insurance policy under the Karnataka Compulsory Gratuity Insurance Rules, 2024 (Gratuity Insurance Rules), framed under the Payment of Gratuity Act, 1972. The Government of Karnataka has clarified that the timeline for obtaining the gratuity insurance policy under the Gratuity Insurance Rules is 6 months and not 60 days for pre-existing establishments from the date of commencement of the Gratuity Insurance Rules.

Government focuses on employment generation, skill development and better women workforce participation in Union Budget 2024

In the Union Budget 2024, the Central Government has focused on employment generation, women workforce participation, and skill development. The Government will introduce 3 schemes to address concerns around unemployment in the formal sector. Initiatives aimed at improving women workforce participation and enhancing skills will be undertaken in collaboration with the industry and State Governments. However, we await the issuance of appropriate notifications, schemes and circulars to implement these changes effectively. We have elaboratively covered this update in our ERGO dated 24 July 2024, available here.

Government introduces guidelines on accessibility standards in the banking sector for persons with disabilities

By way of a notification dated 2 July 2024, the Ministry of Social Justice and Empowerment released the Rights of Persons with Disabilities (Amendment) Rules, 2024 framed under the Rights of Persons with Disabilities Act, 2016 in the Official Gazette. The notification amends Rule 15 of the Rights of Persons with Disabilities Rules, 2017 (Disability Rules), which mandates establishments to comply with specific standards for accessibility concerning the physical environment, transport and information and communication technology. A new clause, clause (p), has been inserted into Rule 15 of the Disability Rules, providing guidelines around the accessibility standards to be maintained for the banking sector as required under the notification issued by the Ministry of Finance dated 2 February 2024. The key accessibility standards involve

- accessibility of counters in terms of meeting the prescribed height specifications, providing tactile guiding indicators for the benefit of persons with visual impairment, and installing hearing enhancement systems along with sign language support;

- sensitization of bank employees to enable them to understand the needs of diverse user groups and better communicate with persons with disabilities, including a mandatory online training at the time of induction;

- accessibility of routes connecting various parts of the building with tactile guiding systems / handrails with braille plates;

- providing an "accessible choice" to individuals by providing accessibility through both steps and ramps

- displaying the name and contact details of the Nodal Officer at bank branches to ensure that persons with disabilities can approach them for their banking needs;

- adherence to IS 17802 (accessibility for the information and communication technology products and services) while upgrading software including for ATMs, websites, and mobile applications;

- availability of e-circulars and other electronic documents including bank statements in accessible formats; and

- formation of board-approved policies to facilitate banking services to persons with disabilities, and an advisory committee consisting of at least one person with disabilities representative to offer suggestions for inclusive and accessible banking services.

Tamil Nadu implements Tamil Nadu Shops and Establishments (Amendment) Amendment Act, 2023

On 2 July 2024, the Government of Tamil Nadu through a notification, implemented the Tamil Nadu Shops and Establishments (Amendment) Amendment Act, 2023, further enforcing the Tamil Nadu Shops and Establishments (Amendment) Act, 2018 effective from 2 July 2024. The amendments stipulate that employers must register their establishments in the prescribed form and ensure proper sanitation and first aid facilities for employees. We have analysed this update in our ERGO dated 17 July 2024, available here.

Introduction of insurance certificate requirements under Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Rules, 2018

Through a notification dated 22 July 2024, published in the Official Gazette, the Government of Maharashtra has introduced Maharashtra Shops and Establishments Rules (Regulation of Employment and Conditions of Service) (Amendment) Rules, 2024 (Amendment Rules 2024) to amend the Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Rules, 2018 (Maharashtra S&E Rules). Through these Amendment Rules 2024, the Government of Maharashtra has introduced the inclusion of insurance related details of establishments in specific forms (such as Form A (application for registration of establishment), Form D (application for renewal of registration), Form F (intimation application) and Form R (filing of annual return)) appended to the Maharashtra S&E Rules. However, the Amendment Rules 2024 do not provide any clarity regarding the specific type of insurance that the establishments are required to obtain.

Case Updates

In this section, we share important judicial decisions rendered in the past one month from an employment and labour law standpoint.

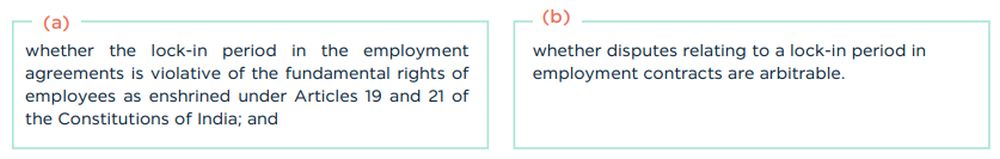

Lock-in period clauses in employment contracts are valid and disputes regarding such clauses are arbitrable: Delhi High Court

In the case of Lily Packers Private Limited v Vaishnavi Vijay Umak and Others [Arbitration Petition Number 1210, 1212 and 1213 of 2023], the Delhi High Court held that disputes around the lock-in periods as mentioned in the employment contracts were arbitrable and such clauses do not violate the fundamental rights of the employees.

The petition was filed on behalf of Lily Packers Private Limited concerning the establishment of an arbitral tribunal under Section 11(6) of the Arbitration and Conciliation Act, 1996, based on the executed service employment contracts between the parties.

The main issues before the Delhi High Court were

The court noted that the reasonable lock-in periods in employment contracts that apply during the term of employment are valid in law and do not violate the fundamental rights of employees as enshrined in the Constitution of India, 1950. Therefore, if such employment agreements contain a clause on arbitration, any disputes pertaining to the lock-in period provided, should be resolved through arbitration as stipulated.

Contract workers cannot claim dues after successful approval of the resolution plan in the corporate insolvency resolution process (CIRP): National Company Law Tribunal, Mumbai (Tribunal)

In the case of Sangharshil Engineering Shramik Sangh and Others v Sanjay Gupta and Others [Interim Application Number 5109 of 2023], the Tribunal held that the claims by contract workers of unpaid wages during the COVID-19 period cannot be admitted after the committee of creditors has approved the resolution plan (Plan) in the CIRP.

The decision arose from an interim application filed by the applicant union (Union) representing 596 contract workers engaged by the respondent company. The Union argued that the contract workers were eligible for unpaid wages during the period when the factory was closed due to COVID-19. While the regular employees of the company were compensated, the contract workers were not. The Tribunal dismissed the application, holding that there was no valid engagement documentation executed with these contract workers by the company. Consequently, their engagement with the company could not be substantiated, and they were not eligible for compensation as per the government circulars requiring the contract workers to be compensated during the COVID-19 period by the employer. The Tribunal further noted that, after the approval of Plan, the successful resolution applicant cannot be burdened with additional claims and is only liable to pay off the claims as recorded in the Plan.

Industry Insights

In this section, we delve into interesting human resources related practices and/or initiatives as well as industry trends across various sectors in the past one month.

India Inc. is enhancing health insurance coverage as a strategy to enhance employee performance and reduce attrition rates

Indian companies are expanding their health insurance plans to cover household help, parents, and parents-in-law of their employees. They are also urging employees to allocate 10% of their annual goals to health-related targets, which will impact their variable pay and bonuses. These initiatives are designed to reduce employee attrition rates and measure performance more holistically. Measures such as mandatory health check-ups, expanded insurance policies, and inclusive benefits are becoming more common these days.

Health goals are being integrated into performance metrics, with several companies now including these goals in employee appraisals. This means that employee performance reviews will take into account progress in areas such as maintaining a healthy body weight, improved sleep cycles, or healthier eating habits. Reports indicate a growing demand for comprehensive healthcare initiatives, with a significant increase in the quantum of insurance coverage amounts and more companies offering flexible benefits.

The content of this document does not necessarily reflect the views / position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up, please contact Khaitan & Co at editors@khaitanco.com.